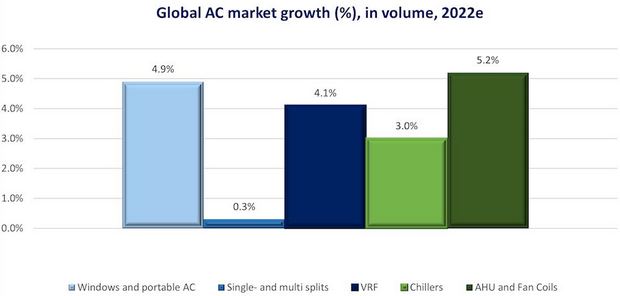

Despite risk concerns, the global air conditioning market keeps growing in 2022

Global research into demand for air conditioning systems has identified the impacts of climate change as being a major driver for increased cooling system demand for a range of purposes.

The UK market for domestic air conditioning systems has significant potential for growth, according to global research from industry body BSRIA.

Avericans

In the US, demand for residential units surged because of changes in consumer behaviour triggered by new workplace practises and extreme weather events. In 2022, the residential market continued to increase in value terms more than in volume due to inflation, which seemed to have levelled off from the year before. In the commercial sector, although the bottlenecks in supply persists, construction demand continues to be robust, especially in verticals such as data centres and technology, healthcare, government, and education. This is benefiting both the VRF and the chiller market. In January and February 2022, the southern hemisphere saw extremely hot weather. Very high inflation and declining foreign reserves led the Argentine government to take a more restrictive stance on the importation of pre-made goods and raw materials. However, domestic production of mini splits increased significantly. In Brazil, new electrical certification requirements for portable and windows triggered the increase in high-wall and mini-splits, while the market for centrifugal chillers has benefited from investments in data centres. In Mexico, sales of residential and commercial air conditioning units are rising.

Asia

Construction holdups in China’s residential market and restrictions brought on by the pandemic in the retail industry both had an impact on air conditioning sales. However, sales of splits were boosted by the summer heat in the third quarter of 2022. The rapid development of new construction, the renovation of energy-efficient buildings, as well as the government’s promotion of public projects, will keep the VRF market growing. As a result of the implementation of the carbon neutrality standards, screw chillers are being replaced by more energy-efficient scroll or centrifugal chillers. While the Thai chiller industry is still uncertain and mostly project-based, the Thai split market has continued to experience supply disruptions and has continued to contract, with costs rising as a result of the increased cost of parts. All segments of the Indonesian splits market saw growth. In 2022, the chiller market recovered; however, it happened unevenly across different verticals. Due to a lack of immigration, the wall-mounted market in Australia is somewhat faltering. Nevertheless, the light commercial and commercial markets are growing. The Australian heat pump market has traditionally been air to water, but orders for water-cooled screw heat pumps are slowly altering this. The trend in the VRF market is toward smaller 4, 5, and 6 hp water-cooled units that heat or cool individual apartments.

Europe

The use of the AC heating mode is becoming more significant in France. There was some strain on the supply of ducted units and multi splits, due to strong demand for these products from light commercial new construction. The current geopolitical events are creating challenges for the chiller business, particularly the worldwide component shortage and the rising cost of materials. From mid-June, extremely hot weather in Germany increased single splits growth rates while multi splits kept expanding their market share in the residential sector. The chiller market continues to shift towards inverter-controlled compressors and alternative refrigerants. Due to low AC penetration in homes, the UK presents a significant development opportunity in light of the acceleration of climate change. By 2022, there will be 40-50 units of 4-pipe chillers on the market, up from 30-40 units in 2021. In the summer of 2022, Italy experienced a heatwave, which helped to boost the splits market. Risk concerns (increasing construction costs, labour scarcity and shortage of supply) weigh heavily on the construction industry and cause delays and longer lead times. Turkey’s inflation increased by more than 80% in the first half of 2022, and as a result of the sharp decline in purchasing power parity, consumers have begun to put off purchases. Screw chillers have primarily been driven by process applications. The Spanish chiller market, despite continuing to improve, is anticipated to stay below pre-pandemic levels in 2022 and 2023. Ductless light commercial single splits, VRFs and multi splits benefit from a return to commercial activity.

Middle East and Africa

Replacement has been the primary market driver for high-wall systems in the United Arab Emirates, whereas delayed and new villa construction funded by the Sheikh Zayed Housing Programme have contributed to a rise in ducted split systems and VRF. The biggest challenge for the CPAC market has been the lack of new commercial construction projects, such as offices. Since July 2022, Saudi Arabia has altered the way energy efficiency is labelled; the less precise EER has been replaced by the more accurate SEER. Sales of screw chillers are currently performing better than centrifugal. Heat waves appeared in South Africa during the first two months of 2022, especially in the Cape Town region. Residential AC unit sales increased as a result. Chinese chiller manufacturers are increasing their presence in large-scale projects.